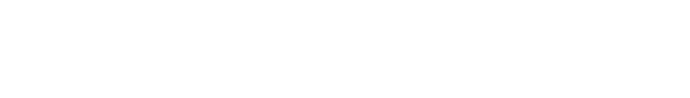

| TCB Small Business Checking |

TCB Small Business

NOW Account

|

TCB Commercial Checking |

TCB Commercial Analysis | |

|---|---|---|---|---|

| Min Bal to Open | $100 | $2,500 | $100 | $100 |

|

Min Bal to Avoid Fees1 & 2

|

$1,000 minimum

daily balance

|

$2,500 minimum

daily balance

|

No minimum

balance required

|

No minimum

balance required

|

| Monthly Service Fee1 & 2 |

$15 per statement cycle plus $0.25 per item in excess of 150 items

|

$15 per statement cycle plus $0.25 per item in excess of 150 items

|

$15 per statement cycle

plus $0.15 per debit, $0.30 per credit, $0.12 per deposited item

|

Contact a TCB representative for schedule of fees. |

| Texas StarCard Debit Card |  |

|

|

|

| Fraud Detection3 |  |

|

|

|

| NetTeller Online Banking |  |

|

|

|

|

E-Statements

2 & 4

|

|

|

|

|

| Mobile Banking Access4 |  |

|

|

|

| Remote Deposit Capture6 |  |

|

|

|

| Bill Payment4 & 7 |  |

|

|

|

| TCB iTalk Access |  |

|

|

|

| Learn More | Learn More | Learn More | Learn More |

(1) Monthly service fee is waived if minimum balance to avoid fees is met. Monthly service fee does not include postage fee or Bill Payment fee.

(2) Current postage fee will be charged if customer does not elect to receive electronic statements.

(3) All debit card activity is monitored by our Fraud Center. Cardholders will receive notifications on suspicious activity via text, e-mail, and phone calls. Message and data rates may apply depending on individual data plans. Refer to our Fraud Protection page for more information.

(4) Customer must be enrolled in NetTeller Online Banking in order to receive electronic statements, access mobile banking features (including Remote Deposit Anywhere), and use Bill Payment.

(5) Remote Deposit Anywhere requires a separate enrollment agreement.

(6) Remote Deposit Capture (for commercial customers only) requires a separate enrollment agreement and approval; fees apply.

(7) Bill Payment available for $5 per month.